Fun & effective UK Driving Theory practice test tool to pass with flying colors

All-in-one platform with everything you need to ace the UK Driving Theory on your first attemptClear and throughout learning path

Step 1

diagnostic test

Step 2

learning

Step 3

full test

Pass

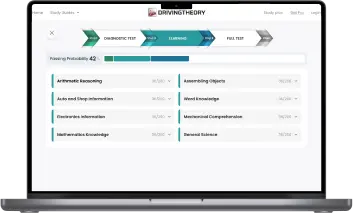

Proven DRIVINGTHEORY 3-step Practice Formula

After our 100.000+ users' success stories, we developed a 3-step strategy to provide you with the most precise and in-depth learning path while minimizing your prep time.UK Driving Theory Diagnostic Test

First, take this short test and get your detailed report showing your strong and weak areas. Save your time by concentrating on what is in demand.Learning

With quick, bite-sized learning techniques and a detailed study guide for each UK Driving Theory section, you can really strengthen your weakness (on step 1) and boost your scores.UK Driving Theory Full Test

The last step for your preparation is taking our full UK Driving Theory practice tests and see how far you've come since the beginning. Repeat the 3-step formula until you satisfy with your results!Ready to start?Thousands of UK Driving Theory users already accomplished

their goals.

NOW it’s your turn!

NOW it’s your turn!

Pass the first time with 3-step formula

What You Get

All-in-one platform

A complete UK Driving Theory Prep Platform, including a diagnostic test, detailed study guides for all topics, practice questions with step-by-step explanations, and various full simulator tests.

Questions nearly identical to those in the real test

All questions are categorized into the specific sections as on the real UK Driving Theory: Same format & same difficulty!

Best for the busy

Easily & quickly grasp all the knowledge with our unique learning technique. And you can learn anytime, anywhere on any devices, even with a few free minutes.

Practice while having fun

Learning or playing? Both! Complete round by round to reach your daily achievement and make a move on your learning part!Start practicing NOW

<p style="text-align: center;"><span style="font-size: 24pt;"><b>Comprehensive Guide To Pass the UK Driving Theory Test</b></span></p>

<p><span style="font-weight: 400;">Even though taking the practical exam is the element of the driver training process that virtually all students fear the most, it is not the very first challenge that students have to surmount. In fact, an applicant must first pass the </span><b>driving theory test</b><span style="font-weight: 400;"> in order to even be eligible to schedule a practical driving examination. With so little information about the theory test, many students may feel as if they do not fully understand what is required of them during the exam.</span></p>

<p><span style="font-weight: 400;">Before you go ahead and take the driving theory exam in the UK, we have provided you with this article, which has comprehensive and detailed instructions covering all you need to know for the driving theory test. Not only will we go through the different kinds of questions that you'll need to solve, but we'll also walk you through how to prepare for the exam and what you can prepare for the test.</span></p>

<h2><b>What is the UK Driving Theory Test?</b></h2>

<p><span style="font-weight: 400;">The <strong>Theory Test</strong> is designed to evaluate both your <em>general driving knowledge and your ability to identify hazard perception</em>. It was <strong>initially implemented on July 1, 1997</strong>, and it is the first stage in the process of becoming a bearer of a full driving license in the United Kingdom. This is a requirement that has to be met before you can schedule your practical driving test.</span></p>

<p><span style="font-weight: 400;">The <strong>UK Driving Theory Test</strong> consists of <em>2 distinct exam parts: a multiple-choice part and a video-based hazard perception part</em>. Both segments are taken separately. In order to <strong>pass the exam</strong>, you will need to get a <strong>score of at least 43 out of a possible 50 points on the multiple-choice portion</strong>, as well as <strong>44 out of a possible 75 points on the Hazard Perception portion</strong>. You won't be allowed to take the practical exam unless both 2 mentioned tests have been successfully completed. In order to succeed in the UK Driving Theory Test, much studying and preparation are required.</span></p>

<p><span style="font-weight: 400;">You will first be given instructions on how to complete the multiple-choice portion of the exam, and then you will have the option to either engage in a practice session or immediately go on to the actual test. The actual exam consists of fifty questions with a variety of response options, and the taker has a total of fifty-seven minutes to respond to the questions. The minimum score required to pass the test for automobiles and motorcycles is 43/50.</span></p>

<p><span style="font-weight: 400;">Learners are only eligible to get their pass certificate if they pass both of the assessments that make up the course. Because of this, they will be able to schedule the practical exam at any point during the following two years, after which it will no longer be valid.</span></p>

<h2><b>How Does the UK Driving Theory Test Work?</b></h2>

<p><span style="font-weight: 400;">The <strong>UK Driving Theory Test</strong> is divided into two sections, which are as follows:</span></p>

<ul>

<li style="font-weight: 400;" aria-level="1"><span style="font-weight: 400;">Part 1 – Multiple choice questions test</span></li>

<li style="font-weight: 400;" aria-level="1"><span style="font-weight: 400;">Part 2 – Hazard perception test</span></li>

</ul>

<h3><b>Part 1 - Multiple choice questions test</b></h3>

<p><span style="font-weight: 400;">Your knowledge of the <strong>Highway Code and the official DVSA</strong> guidelines on driving abilities will be put to the test via a series of <strong>50 multiple-choice questions</strong>. The questions are regularly updated so that they are consistent with the most recent law. This test consists of 45 questions with multiple-choice answers and 5 case-study questions.</span></p>

<p><span style="font-weight: 400;">The case study is given in the form of a short story and is based on a hypothetical circumstance that may occur in real life. You need to get at least 43 of the questions right within the allotted time of 57 minutes to successfully pass the test.</span></p>

<p><span style="font-weight: 400;">You are free to go on to the next question if you are unsure of the answer you are now considering, 57 minutes are limited. After you have reached a point where you are satisfied with your answers, double-check the exam, and then hand it in.</span></p>

<h3><b>Part 2 – Hazard perception test</b></h3>

<p><span style="font-weight: 400;">After you have finished the portion with the multiple choice questions, you will go on to the <strong>hazard perception portion</strong> of the examination. The hazard perception test is designed to assist drivers to improve their scanning capabilities and acquire the ability to see hazards at an earlier stage. This section has a minimum passing score of 44/ 75.</span></p>

<p><span style="font-weight: 400;">You will first watch a brief movie that provides some background information before getting started. This plays a series of films showing ordinary scenarios of people driving on roads, some of which have one emerging hazard and others of which contain two. Some of the films feature both of these hazards. You will next see 14 video clips depicting typical scenarios found on roads. At least one "emerging hazard" may be found in each scene of the video. </span></p>

<p><span style="font-weight: 400;">You get points for correctly identifying hazards as soon as they emerge. You have the potential to earn up to 5 points for each risk. Learner drivers are required to make a mouse click whenever they see a potentially hazardous situation. They are then graded on the speed of their response. However, don't think you can cheat the system. If you keep clicking on the screen in an effort to 'discover' the hazards, your score will reset to zero automatically.</span></p>

<p><span style="font-weight: 400;">In addition, in contrast to the first portion of the exam, you will only have one chance to answer each question, and you will not be able to go back and amend your answers or review them.</span></p>

<h2><b>When Do You Need to Do the UK Driving Theory Test?</b></h2>

<p><span style="font-weight: 400;">Before you may schedule your practical driving exam, as a learner driver you are required to pass your driving theory test. If you already have a complete driver's license, on the other hand, you may not need to take a new theory exam if you wish to start driving a new vehicle. This is because you already have the knowledge necessary to pass the test.</span></p>

<h3><b>UK Residency</b></h3>

<p><span style="font-weight: 400;">If you wish to <em>take either the theory or the practical driving exam in the UK</em>, you are required by law to be a normal resident of the <strong>UK</strong>. This is the case whether you want to take the theory test or the practical test. Before you can schedule your theory test for a motorcycle, car, bus, or lorry in the UK, you will be required to fill out a residency declaration form and send it to <strong>DVA</strong> along with proof that you are a resident of the UK. This is the case even if you already have a provisional license from Great Britain.</span></p>

<h3><b>UK License Holders</b></h3>

<p><span style="font-weight: 400;">If you wish to get a license for a different kind of vehicle, you are going to have to <em>take a theoretical exam firs</em>t. If you already have a driver's license for a vehicle and you wish to get a motorbike license, for instance, you will need to <strong>take a theory test</strong> that is particular to that category.</span></p>

<p><span style="font-weight: 400;">If, on the other hand, you wish to move up within the same category of vehicles, you will often not be required to take another theoretical exam. If you already have a driver's license for a fully automated automobile and you wish to <strong>get a license for a manual car</strong>, for instance, you won't have to take a theoretical test.</span></p>

<p><span style="font-weight: 400;">It is your duty to check that you are in possession of a license that is appropriate for the vehicle you are operating at all times. Contact the <strong>Driver and Vehicle Agency</strong> if you are unclear as to whether or not you are required to take a <strong>theory exam (DVA)</strong>.</span></p>

<h3><b>European Economic Area (EEA) License Holders</b></h3>

<p><span style="font-weight: 400;">If you have a community license that is still current and you are traveling in the UK, you are permitted to drive whatever car you want for as long as your license is still active. Your driver's license has to clearly demonstrate that you are authorized to operate the car you want to drive. In this case, a driving theory test is not required.</span></p>

<p><span style="font-weight: 400;">The European Economic Area (EEA) is comprised of the following countries: Austria, Belgium, Bulgaria, the Czech Republic, the Republic of Cyprus, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Ireland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, the Netherlands, Norway, Poland, Portugal, Romania, Slovenia, Slovakia, Spain, Sweden, and the United Kingdom.</span></p>

<h3><b>Foreign license holders</b></h3>

<p><span style="font-weight: 400;">If you have a complete driver's license that was granted in a country that is not part of the EEA, you may be able to trade it in for an equivalent license in the UK. You need to get in touch with DVA to find out whether you may trade in your current license from another country. If you are unable to exchange your license from another country, you will be required to submit an application for a temporary license in the UK and pass the driving theory test.</span></p>

<h2><b>Book Your UK Driving Theory Test</b></h2>

<h3><b>Before Getting Started</b></h3>

<p><span style="font-weight: 400;">Before you can take your theory or driving test, you need to have resided in England, Wales, or Scotland for at least 185 days during the last year before the exam day.</span></p>

<p><span style="font-weight: 400;">The fees for the car and motorbike tests are each £23.</span></p>

<p><span style="font-weight: 400;">Lorry and bus exams cost:</span></p>

<ul>

<li style="font-weight: 400;" aria-level="1"><span style="font-weight: 400;">Part 1a (multiple-choice questions) - £26</span></li>

<li style="font-weight: 400;" aria-level="1"><span style="font-weight: 400;">Part 1b (hazard perception) - £11</span></li>

<li style="font-weight: 400;" aria-level="1"><span style="font-weight: 400;">Part 2 (case studies) - £23</span></li>

</ul>

<p><span style="font-weight: 400;">Please let the proctor know if you have any reading difficulties, health conditions, or disabilities when you schedule your exam.</span></p>

<h3><b>When You Do not Need to Take the UK Driving Theory Test</b></h3>

<p><span style="font-weight: 400;">In order to upgrade your license, it is not required for you to complete the Driving Theory Test:</span></p>

<ul>

<li style="font-weight: 400;" aria-level="1"><span style="font-weight: 400;">An automated automobile license to a manual car license</span></li>

<li style="font-weight: 400;" aria-level="1"><span style="font-weight: 400;">From category A1 (small motorcycle) to category A2 (medium motorcycle) if you’ve had the license for at least 2 years</span></li>

<li style="font-weight: 400;" aria-level="1"><span style="font-weight: 400;">From category C1 (medium vehicles) to category C (large vehicles) unless you got your C1 entitlement from passing a car driving test</span></li>

<li style="font-weight: 400;" aria-level="1"><span style="font-weight: 400;">From category D1 (minibus) to category D (bus)</span></li>

<li style="font-weight: 400;" aria-level="1"><span style="font-weight: 400;">Any license is acceptable to be allowed to pull a trailer.</span></li>

</ul>

<h3><b>How to Book the UK Driving Theory Test?</b></h3>

<p><span style="font-weight: 400;">Booking your Driving Theory Test directly via the website of the DVSA is both the most cost-effective and convenient option. There are many websites that enable you to schedule the exam, and many of them have a design that is quite similar to that of the DVSA. Nevertheless, they will charge you additional fees and provide services like pass protection, which the DVSA would never provide for its customers.</span></p>

<p><span style="font-weight: 400;">You may obtain assistance with scheduling your Driving Theory Test by getting in touch with the Driver and Vehicle Standards Agency (DVSA). Contact this:</span></p>

<ul>

<li style="font-weight: 400;" aria-level="1"><span style="font-weight: 400;">[email protected]</span></li>

<li style="font-weight: 400;" aria-level="1"><span style="font-weight: 400;">Telephone: 0300 200 1122</span></li>

</ul>

<p><span style="font-weight: 400;">If the domain name of the website you're on does not end with .gov.uk, then you are now at the wrong place.</span></p>

<h2><b>What Happens on the Driving Theory Test Day?</b></h2>

<p><span style="font-weight: 400;">In order to ensure that you have the time to study for the examination, you need to ensure that you arrive at the testing facility at least ten minutes early. At the time of your arrival, you will need to <em>provide the administrator with a copy of your provisional driver's license</em> so that they may review your information and verify that you have a reservation.</span></p>

<p><span style="font-weight: 400;">After this, you will be asked to check-in, and then you will be sent to a locker to keep your personal items. You are required to empty your pockets, and take off any jewelry, including watches and bracelets. Before you lock your mobile phone away for the night in your locker, please ensure that it is turned off and unplugged.</span></p>

<p><span style="font-weight: 400;">Before you are allowed to take the exam, you will first need to go through the policies and procedures that will be used during the test. After that, you will be shown to the testing room and given a computer at which to complete the theory portion of the exam.</span></p>

<p><span style="font-weight: 400;">The <strong>driving theory exam has a total of 57 minutes</strong> for the multiple choice questions and <strong>1 hour and 20 minutes for the written portion</strong>. Some individuals finish the written portion of the test earlier than others. After you have turned in the first section, you have the option of taking a short break of three minutes or proceeding immediately to the hazard perception test, which lasts for twenty minutes.</span></p>

<h2><b>Getting Your UK Driving Theory Test Results</b></h2>

<p><span style="font-weight: 400;">Your results will be provided to you at the testing site in the form of a printed letter not long after you have completed the exam.</span></p>

<p><span style="font-weight: 400;">If you are successful, you will be sent a letter that has the number of your pass certification on it. You'll need the number in order to schedule your practical exam, so tuck this away somewhere secure for safekeeping. If you misplace it, you may look up the number of your passing certification on the GOV.UK website.</span></p>

<p><span style="font-weight: 400;">The fact that you passed your exam is certainly a cause for celebration, but the hard job is far from over. You'll need to demonstrate that you can put the information you gained from studying driving theory into practice when you take your practical driving exam, and you'll need to keep that knowledge fresh throughout your whole driving career.</span></p>

<p><span style="font-weight: 400;">If you don't get a passing score, you won't be able to repeat the exam for at least three full working days after you've failed it.</span></p>

<h2><b>What Happens If You Fail the UK Driving Theory Test?</b></h2>

<p><span style="font-weight: 400;">If you made it through, we offer our sincere congratulations. You will be given a certificate indicating that you passed the theoretical exam. This includes your theoretical pass number, which you'll need in order to log in to the <strong>DVSA's online practical test booking service</strong> once you've completed your theory test. You could also get a brochure in the mail with helpful instructions on what to do after this.</span></p>

<p><span style="font-weight: 400;">Even if the piece of paper you get shows that you haven't passed this time, you shouldn't be too concerned about it since more than half of those taking the <strong>Theory Test fail</strong>.</span></p>

<p><span style="font-weight: 400;">Don't throw in the towel! You will need to wait another three days before you can schedule another theoretical exam; therefore, make the most of this time by reviewing any topics that you find challenging. Check first to see if your lower score was in the Theory or Hazard Perception section; once you know where your weak spot is, you will know where to concentrate your studying moving ahead.</span></p>

<p><span style="font-weight: 400;">If the amount of time you spent revising was less than four weeks, then the odds are that you probably need to spend a little bit more revising. It may be worthwhile to reflect on how much time you spent revising. You should give yourself a couple of additional weeks to go through the complete question bank (730 questions), and then you should rebook the exam when you feel like you are prepared for it.</span></p>

<p><span style="font-weight: 400;">Keep your theoretical knowledge current at all times, since this is of the utmost importance. Even though you won't be taking the exam again, the knowledge you've received here will serve you well once you hit the road for real and will provide the groundwork for you to become a responsible and self-assured motorist for the rest of your life.</span></p>

<h2><strong>Our Driving Theory Practice Tests</strong></h2>

<p><b>Driving Theory Test Application features</b></p>

<ul>

<li><span style="font-weight: 400;"><strong>Free Practice Questions</strong>: <em>800+ FREE <a href="https://drivingtheory-tests.com/">Driving Theory Test practice questions</a></em> with detailed explanations are available for all of the required skills. All you need to pass your recruitment test is available here.</span></li>

<li><span style="font-weight: 400;"><strong>Theory Test Practice Tests Based On Real Tests</strong>: Same number of questions, same time limits, same structure. The exam simulators let you familiarize yourself with the test format and get totally ready for the real one.</span></li>

<li><span style="font-weight: 400;"><strong>No Sign-Up Or Login Required</strong>: All of your progress is saved without an account, even if you close your browser. But login can sync your data between web and mobile applications.</span></li>

<li><span style="font-weight: 400;"><strong>Gamification:</strong> The learning process will be divided into small milestones. Let’s make your studying exciting as if you were in some interesting games.</span></li>

<li><span style="font-weight: 400;"><strong>Personal Study Plan</strong>: Just enter your <strong>Driving Theory Test test date</strong>, and a study plan will be set up for you. A clear schedule will surely exceed your expectation and get you the best preparation for the reading shot.</span></li>

<li><span style="font-weight: 400;"><strong>3 Interesting Test Modes</strong>: 3 different test modes with increased difficulty levels let you experience the test in various ways.</span></li>

<li><span style="font-weight: 400;"><strong>Dark Mode</strong>: Experience a dark theme that is more friendly to your eyes, and get a whole new and marvelous experience.</span></li>

<li><span style="font-weight: 400;"><strong>No Internet Required</strong>: Study on the go conveniently without any Internet connection. </span></li>

<li><span style="font-weight: 400;"><strong>Driving Theory Test Test Bank</strong>: 3 features: Weak/ Medium/ Strong questions help you clearly determine which area you should pay more attention to.</span></li>

</ul>

<h2><b>FAQs About Driving Theory Test</b></h2>

<h3><b>Who sets the Driving Theory Test?</b></h3>

<p><span style="font-weight: 400;">The Driver and Vehicle Standards Agency (DVSA) is the one that determines the content of the Theory Test. This is not to be confused with the Driver and Vehicle Licensing Agency (DVLA), which is the organization in charge of handing you driver's licenses as well as your Provisional Driving License.</span></p>

<h3><b>How long is a certificate of Driving Theory valid?</b></h3>

<p><span style="font-weight: 400;">Your certificate of passing the theoretical exam is valid for two years. If you do not pass your practical exam within this time period, you will be required to repeat your theoretical test before you are allowed to schedule your practical test.</span></p>

<h3><b>How much time is allotted for the Driving Theory Test?</b></h3>

<p><span style="font-weight: 400;">The driving theory exam has a total of 57 minutes for the multiple choice questions and 1 hour and 20 minutes for the written portion. Some individuals finish the written portion of the test earlier than others.</span></p>

<p><span style="font-weight: 400;">After you have turned in the first section, you have the option of taking a short break of three minutes or proceeding immediately to the hazard perception part, which lasts for twenty minutes.</span></p>

<h3><b>What do I need to bring to my Driving Theory Test?</b></h3>

<p><span style="font-weight: 400;">You'll need to remember to bring in your driver's license with the picture card. If you do not bring the required form of identification with you to the test, you will not be able to take the exam and your booking money will be forfeited. If you just have the old paper license, you are going to need to bring up a signed copy of your driving license as well as a passport that is still valid.</span></p>

<h3><b>When can I take the Driving Theory Test?</b></h3>

<p><span style="font-weight: 400;">As soon as you reach 17, when your temporary license becomes active, you will be able to start studying for your theoretical exam. If you are eligible for or already receive, the increased rate of the mobility component of the Personal Independence Payment, then you may start receiving it on the day you become 16 years old.</span></p>

<h3><b>What kinds of questions can I expect to be asked?</b></h3>

<p><span style="font-weight: 400;">You will be asked questions from the <strong>14 official question categories</strong> that have been defined by the <strong>Driver and Vehicle Standards Agency (DVSA)</strong>. Accidents, Alertness, Attitude, Documents, Hazard Awareness, Motorway Rules, Other Types of Vehicles, Road and Traffic Signs, Rules of the Road, Safety and Your Vehicle, Safety Margins, Vehicle Handling, and Vulnerable Road Users are some of the topics that fall under this category.</span></p>

<p><span style="font-weight: 400;">It is in your best interest to put in as much practice as you can before taking the Driving Theory Test for automobile drivers since there are a total of 730 questions on the test that might be asked of you!</span></p>

<p>You can use our free <strong>Theory practice questions</strong> to get ready for your coming exam!</p>

<h3><b>How is the Driving Theory Test taken?</b></h3>

<p><span style="font-weight: 400;">The Theory Test consists of two separate exams, both of which must be taken on the same day and are administered on a computer at an approved DVSA test center. The first is a multiple-choice examination that is based on the guidelines for safe driving that have been established by the DVSA, and the second is a Hazard Perception Test.</span></p>

<h3><b>What is the required score to pass the Car Driving Theory Test?</b></h3>

<p><span style="font-weight: 400;">In Great Britain and Northern Ireland, the minimum score required to pass the beginner driving test for a vehicle is currently set at 43/50. You need to get a score of 44/75 on the hazard perception test. The current pass percentage is just 47.3%, which indicates that more than half of all individuals who take the Theory Test will fail.</span></p>

<h3><b>How difficult is it to go through the Driving Theory Test?</b></h3>

<p><span style="font-weight: 400;">It is difficult to provide an accurate response to this issue since it is contingent upon the amount of preparation and practice that has been put in, but on average, around one in three persons will fail their Theory Test.</span></p>

<p><span style="font-weight: 400;">The effectiveness of your study materials is another factor to consider, particularly with regard to the Hazard Perception portion of the examination. Because there is no opportunity to see the real video clips before your exam, many people believe that the Hazard Perception Test is more challenging than the section where you have to choose answers from a set of predetermined options.</span></p>

<h3><b>Can I receive feedback?</b></h3>

<p><span style="font-weight: 400;">You will be provided with feedback about the subject areas in which you answered questions incorrectly on the multiple choice exam, as well as the total number of questions that you answered incorrectly. You will be given a rundown of how well you did on the hazard perception test, including how well you scored on the clips.</span></p>

<p><span style="font-weight: 400;">Above is all the related information about the </span><b>Driving theory test</b><span style="font-weight: 400;"> in the UK. We hope that this article can be beneficial for you during the process of taking this test so that you can successfully pass it and become a good driver.</span></p>

<p> </p>

Read more